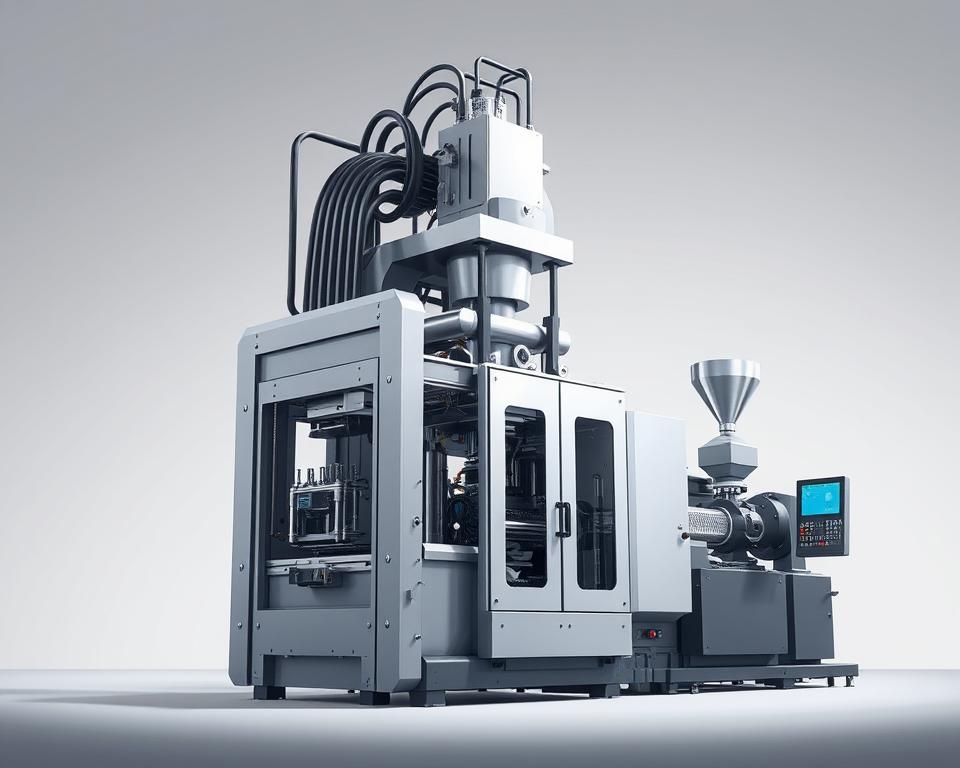

Best Practices for Sourcing Injection Molding from China

So, the big meeting just wrapped up. your new product is a go, the timeline is aggressive, and the budget is… well, let’s just say it’s tight.. Then someone—maybe your boss, maybe the finance director—utters the phrase that sends a little jolt down every project manager’s spine: “We should look at sourcing this from China.”

Of course, you acknowledge. It seems sensible at first glance. The cost savings can be huge. However, your brain is racing with concerns. You’ve heard all the horror stories, right? Quality failures, endless communication gaps, shipments arriving months late and nothing like the prototype. It can feel like you’re being asked to walk a tightrope between landing a huge cost win for the company and steering your project straight into a ditch.

But here’s the catch. Sourcing plastic mold can be a calculated project. It’s no different from any structured project. And like any project, it succeeds or fails based on the process you follow. It isn’t about the cheapest offer but about choosing the right supplier and running the process transparently. Disregard those scary tales. Let’s go through a step-by-step guide to succeed.

Initial Step: Prepare Your Information

Before searching suppliers or opening Alibaba, nail down your requirements. Honestly, more than half of all overseas manufacturing problems start right here, with a weak or incomplete information package. You cannot expect overseas partners to interpret your unspoken requirements. Sending a vague request is like asking a builder to quote you for “a house.” You’ll get wildly varied quotes that are useless.

Aim to craft an RFQ package so precise and comprehensive it leaves no room for error. This becomes the bedrock of your sourcing project.

What should you include?

Begin with 3D CAD models. They’re essential. Use standard formats such as STEP or IGS to ensure compatibility. This serves as the definitive part geometry reference.

But 3D isn’t enough. Include precise 2D engineering drawings. This is where you call out the stuff that a 3D model can’t communicate. Examples include tolerances (e.g., ‘25.00±0.05 mm’), material grade, surface finish requirements, and functional callouts. Any seal surfaces or critical hole sizes must be clearly labeled.

Next up, material. Don’t label it simply “Plastic.” Don’t even just say “ABS.” Be explicit. If you need SABIC Cycolac MG38 in black, say exactly that. What’s the reason? Because resin grades number in the thousands. Defining the exact material guarantees the performance and appearance you designed with plastic mold injection.

Your supplier might propose substitutes, but you must set the baseline.

Don’t forget the commercial info. State your EAU. A supplier needs to know if they’re quoting a tool that will make 1,000 parts in its lifetime or 1,000,000 parts a year. Cavity count, tooling cost, and per-unit pricing depend on volume.

The Great Supplier Hunt

With your RFQ perfected, now, who do you send it to? The web is vast but overwhelming. Finding suppliers is simple; finding quality ones is tough.

You’ll probably kick off on Alibaba or Made-in-China. These are great for casting a wide net and getting a feel for the landscape. Use them to build a shortlist, not the final list. Aim for a preliminary list of 10–15 potential partners.

But don’t stop there. Consider using a sourcing agent. They do cost extra. But a good one has a vetted network of factories they trust. They handle local liaison and oversight. As a newcomer, this offers priceless security. Think of it as insurance for your project timeline.

Another tactic: trade exhibitions. If you have the travel budget, attending a major industry event like Chinaplas can be a game-changer. Nothing beats a face-to-face conversation. You can handle sample parts, meet the engineers, and get a gut feeling for a company in a way that emails just can’t match. Also, leverage the tried-and-true referral network. Tap your professional contacts. A solid referral can be more valuable than any ad.

Sorting the Contenders from the Pretenders

Now you have your long list of potential suppliers and you’ve sent out your beautiful RFQ package. bids begin to arrive. You’ll see ridiculously low offers and steep quotes. Your task is to filter them down to 2–3 credible finalists.

How to proceed? It blends technical checks with intuition.

First, look at their communication. Are their replies prompt and clear? Is their English good enough for complex technical discussions? The true litmus: are they raising smart queries? Top vendors will critique and inquire. “Have you considered adding a draft angle here to improve ejection?” or “We see your tolerance requirement here; our CMM can verify that, but it will add to the inspection time. Is that acceptable?” That’s a huge positive sign. It shows they’re engaged and experienced. Anyone who simply agrees to all specs is a red flag.

Next, dig into their technical capabilities. Get their tooling inventory. Seek samples or case studies of comparable projects. If you’re making a large, complex housing, you don’t want a shop that specializes in tiny gears.

Then comes the audit. Skipping this is a mistake. You would never hire a critical employee without an interview, so why would you send tens of thousands of dollars for a tool to a company you’ve never truly vetted? You can either go yourself or, more practically, hire a third-party auditing firm in China to do it for you. They dispatch an on-site auditor for a day. They will verify the company is real, check their quality certifications like ISO 9001, assess the condition of their machinery, and get a general feel for the operation. It’s a tiny cost for huge peace of mind.

From Digital File to Physical Part

You’ve selected your partner. you’ll agree on terms, typically 50% upfront for tooling and 50% upon first-sample approval. Now the process kicks off.

Initially, expect a DFM report. Design for Manufacturability (DFM) is essential. It’s the engineering critique for moldability. The report calls out sink-risk zones, stress-causing corners, and draft angle gaps. Comprehensive DFM equals a top-tier supplier. It becomes a joint effort. You iterate with their team to optimize the mold.

With DFM sign-off, toolmaking begins. Weeks on, you receive the thrilling “T1 samples shipped” notification. These are the very first parts off the new tool. They are your moment of truth.

T1 parts usually require adjustments. That’s standard process. You’ll find minor defects, off-spec dimensions, or finish issues. You critique, they refine, and T2 plastic mold company parts arrive. It could require several iterations. Plan for this loop in your schedule.

At last, you get the perfect shot. It matches all specs, has a pristine finish, and works as required. This becomes the “golden sample.” You ratify it, and it becomes the quality yardstick for production.

Completing the Sourcing Journey

Landing the golden sample is huge, yet the project continues. Now comes full-scale production. How do you maintain consistency for part 10,000?

Put a strong QC process in place. Often, you hire a pre-shipment inspection service. Bring in an external QC firm. They’ll randomly select parts, compare them to specs and golden sample, and deliver a detailed report. They’ll send you a detailed report with photos and measurements. After your approval, you release the shipment and final funds. This step saves you from a container of rejects.

Finally, think about logistics. Know your shipping terms. Is your price FOB (Free On Board), meaning the supplier’s responsibility ends when the goods are loaded onto the ship in China? Or EXW, where you handle everything from their gate? Your Incoterm selection drives landed expenses.

Sourcing from China is a marathon, not a sprint. It hinges on strong supplier relations. View them as allies, not vendors. Clear communication, mutual respect, and a solid process are your keys to success. No question, it’s demanding. But with this framework, it’s one you can absolutely nail, delivering the cost savings everyone wants without sacrificing your sanity—or the quality of your product. You’ve got this.